Offers ICICI Net Banking Corporate Login (CIB) services, empowering businesses with easy access to a range of banking services from anywhere, at any time. ICICI Corporate Net Banking provides a robust platform for businesses to manage their finances, make secure transactions, and track their financial operations efficiently. Whether it’s processing bulk payments, managing payrolls, or handling foreign exchange transactions, ICICI’s Corporate Internet Banking (CIB) has you covered.

In this guide, we’ll explore the various aspects of ICICI Corporate Net Banking, including the types of services offered, how to apply, and how to log in and use the platform for seamless financial operations.

Types of ICICI Corporate Banking

ICICI Bank provides a wide range of corporate banking services that cater to businesses of all sizes, from small and medium enterprises (SMEs) to large multinational corporations. The bank offers Corporate Internet Banking (CIB) solutions tailored to meet the specific needs of businesses in various sectors. Here are the primary types of corporate banking services:

- Cash Management Services (CMS)

CMS is designed to streamline cash flow and ensure businesses can efficiently manage their receivables and payables. ICICI Bank’s CMS provides companies with automated solutions for collections, payments, and liquidity management. - Trade Services

ICICI offers a suite of trade services, including letters of credit, export/import financing, and foreign exchange management. These services are essential for businesses engaged in cross-border transactions. - Corporate Loans and Credit

ICICI Corporate Banking provides customized loan solutions, including working capital finance, term loans, and credit facilities, designed to meet the unique requirements of businesses. - Foreign Exchange Services

Companies involved in international trade can access foreign exchange services, including currency conversion and risk management solutions. - Treasury and Investment Solutions

ICICI offers corporate clients the ability to invest surplus funds in secure instruments and manage their treasury needs effectively.

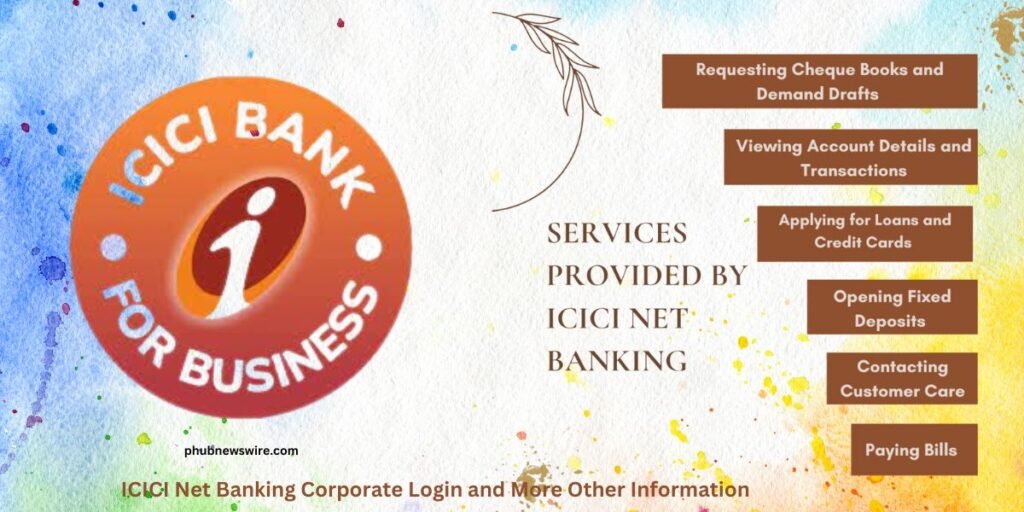

Services Offered in ICICI Corporate Internet Banking (CIB)

ICICI Bank’s Corporate Internet Banking (CIB) platform provides a comprehensive suite of services tailored to meet the diverse financial needs of businesses. Key services include:

- Account Management: Access real-time information on account balances and transactions. Download account statements in various formats for efficient financial tracking.

- Fund Transfers: Conduct seamless intra-bank and inter-bank fund transfers using NEFT and RTGS. The platform also supports bulk payments, facilitating efficient salary disbursements and vendor payments.

- Cheque Book and Demand Draft Requests: Order cheque books and request demand drafts online, streamlining payment processes. ICICI Bank

- Fixed Deposits: Initiate and manage fixed deposit accounts, allowing for effective investment of surplus funds.

- Loan and Credit Card Applications: Apply for corporate loans and credit cards through the platform, simplifying access to credit facilities.

- Bill Payments: Pay utility bills, taxes, and other obligations directly through the CIB platform, ensuring timely and hassle-free payments.

- Customer Care: Access dedicated customer support for prompt assistance with any banking queries or issues.

Read Also: Vishnu Nivasam Hotel

ICICI Corporate Net Banking Benefits

ICICI Corporate Net Banking offers a range of benefits to businesses, making it an indispensable tool for managing financial transactions and operations. Here are some of the key benefits:

- Convenience and Flexibility

Corporate clients can access their accounts anytime, anywhere, using ICICI’s secure online platform. This enables businesses to handle urgent transactions even outside regular banking hours. - Multi-Level Authorization

ICICI CIB supports a multi-level authorization process, allowing businesses to enforce secure transaction approvals by authorized personnel. This reduces the risk of unauthorized transactions. - Real-Time Access

Businesses can monitor their accounts and transactions in real-time, ensuring that they always have up-to-date information about their finances. - Security

ICICI Corporate Net Banking incorporates strong encryption and authentication methods, ensuring that sensitive financial data and transactions are secure. - Cost Savings

By using the online platform, businesses can reduce the need for physical visits to the bank, saving time and money.

Read Also: Boho Farms Indore

Features and Services of ICICI Net Banking

ICICI Corporate Net Banking is a feature-rich platform that helps businesses manage their operations efficiently. Here are some of the standout features:

- Bulk Transactions: Businesses can perform bulk transactions such as payroll disbursements, vendor payments, and tax payments.

- Forex and Treasury Solutions: Companies involved in international business can benefit from ICICI’s comprehensive forex services, hedging solutions, and treasury management.

- Tax Payments: The platform supports payment of direct and indirect taxes, including income tax, GST, and TDS.

- Customized Reports: Corporate clients can generate customized financial reports for audits, financial planning, and compliance purposes.

- Transaction Alerts: Stay updated with real-time SMS and email alerts for every transaction made on the account.

- Account Management: Manage multiple accounts, monitor real-time transactions, view account statements, and track balances from one centralized dashboard.

Steps to Register for ICICI Bank Net Banking Services

To use the services offered by ICICI Corporate Internet Banking, businesses must first register for the service. Here’s a step-by-step guide:

Step 1: Visit the Official Website

Go to the official ICICI Bank website and navigate to the Corporate Internet Banking section.

Step 2: Download the Application Form

Download the application form for Corporate Net Banking from the website. This form will require details about the company and the authorized users who will access the platform.

Step 3: Fill in the Details

Complete the application form by providing necessary information such as corporate ID, contact details, and authorized personnel information.

Step 4: Submit the Form

Submit the filled-out form at the nearest ICICI Bank branch or send it via courier. Ensure that you attach all the required documents, including KYC details.

Step 5: Receive Login Credentials

Once your application is processed, ICICI Bank will provide you with your corporate ID, user ID, and password. These credentials will be required to log in to the Corporate Internet Banking platform.

How to Apply for an ICICI Corporate Internet Banking (CIB)

- Visit the Nearest Branch

You can start by visiting the nearest ICICI Bank branch and requesting the Corporate Internet Banking application form. - Fill Out the Application

Complete the application form with the necessary business details, such as company name, address, and authorized signatories. - Submit KYC Documents

Attach all the required KYC documents, including company registration certificates, identification documents of authorized users, and address proof. - Receive Confirmation

Once the bank verifies your documents, you will receive a confirmation of your Corporate Internet Banking registration, along with your login credentials.

How to Login in ICICI Corporate Internet Banking

Logging in to ICICI Corporate Internet Banking is simple. Here’s how:

- Step 1: Visit the Corporate Internet Banking Portal

Go to the official ICICI Corporate Internet Banking website using a secure browser. - Step 2: Enter Corporate ID, User ID, and Password

On the login page, enter your corporate ID, user ID, and password to access the platform. Make sure your credentials are correct to avoid account lockouts. - Step 3: Access Your Account Dashboard

Once logged in, you will be directed to the account dashboard where you can view your accounts, make payments, and monitor transactions.

How to Transfer Funds Through ICICI Corporate Net Banking

Transferring funds through ICICI Corporate Net Banking is an efficient and secure process. Here are the steps to initiate a transfer:

Step 1: Visit the Corporate Internet Banking Portal

Log in to the ICICI Corporate Internet Banking portal using your corporate ID, user ID, and password.

Step 2: Access the Transfers Menu

After logging in, click on the Transfers option from the main dashboard menu.

Step 3: Choose NEFT/RTGS

Select the payment mode (NEFT or RTGS) based on your preference and the amount to be transferred. Choose the registered payee from the list.

Step 4: Enter Transaction Details

Input the amount to be transferred, and if needed, click “Look Up” to select the next authorizer for the transaction.

Step 5: Choose the Authorizer

Select the authorizer from the list provided. In some cases, companies require multiple authorizations to process high-value transactions.

Step 6: Enter Transaction Password

Input your transaction password to authenticate the transfer.

Step 7: Confirm Transaction

Finally, click “Confirm” to complete the transaction. A confirmation message will be displayed once the transfer is successful.

FAQs

How can I register for ICICI Corporate Net Banking?

To register for ICICI Corporate Net Banking, you need to download the application form from the ICICI Bank website or visit the nearest branch. Fill out the form with your company details and submit it along with the required KYC documents. After processing, the bank will provide your login credentials.

Is there a limit on fund transfers through ICICI Corporate Net Banking?

Yes, ICICI Corporate Net Banking imposes transaction limits depending on the payment method (NEFT, RTGS) and your company’s pre-defined settings. These limits ensure security and help manage large or frequent transactions.

How can I reset my Corporate Internet Banking password if I forget it?

To reset your password, visit the ICICI Corporate Net Banking login page and click on “Forgot Password.” You will be asked to verify your identity using your registered email or mobile number. Follow the instructions to set a new password.

Can I manage multiple accounts under one Corporate Net Banking login?

Yes, ICICI Corporate Net Banking allows businesses to manage multiple accounts under a single login. You can view balances, initiate transactions, and track financial activity across all linked corporate accounts.

Is ICICI Corporate Net Banking secure for high-value transactions?

Yes, ICICI Corporate Net Banking is equipped with multi-layered security, including encryption, two-factor authentication, and transaction passwords. For high-value transactions, the platform supports multi-level authorization to ensure added security.